Market Size & Trends

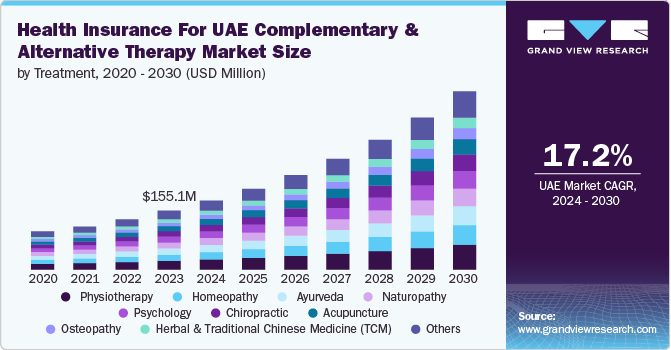

The health insurance for UAE complementary and alternative therapy market size was valued at USD 155.08 million in 2023 and is projected to grow at a CAGR of 17.17% from 2024 to 2030. There is a growing number of government initiatives and regulations that improve health coverage for these treatments, along with the increasing availability of coverage plans from providers, reflects a rising consumer preference for holistic health solutions. These factors contribute to the expansion and integration of alternative therapies into mainstream healthcare.

The UAE government’s proactive initiatives and regulations are driving significant growth in the market for Complementary and Alternative Therapies (CAM). By mandating health insurance coverage for all private sector employees, including domestic workers, by 2025 and expanding existing requirements in Abu Dhabi and Dubai, the government is enhancing access and standardizing healthcare coverage. This regulatory push is expected to include CAM therapies, encouraging employers to consider supplementary health benefits. As the UAE evolves its healthcare system with a focus on integrating CAM into mainstream practices, the establishment of comprehensive health insurance regulations and public-private partnerships will further legitimize and expand access to these therapies. This aligns with the UAE’s broader goal of improving healthcare quality and positioning itself as a hub for diverse, world-class treatment options.

Furthermore, ayurveda is becoming increasingly popular in the UAE due to the rising demand for holistic wellness solutions and the growing number of Ayurvedic clinics and wellness centers. Lifestyle-related diseases are on the rise, and many people are dissatisfied with conventional treatments. Hence, residents are turning to Ayurveda owing to its natural, preventive, and personalized approach. This shift is supported by the increasing popularity of CAM therapies such as yoga and meditation, particularly among the younger population seeking comprehensive wellness solutions. The increasing prevalence of chronic conditions and the shift towards holistic health are leading providers to include CAM therapies in their coverage plans, demonstrating a broader acceptance and integration of these treatments into the UAE’s healthcare system.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, impact of regulations, degree of innovation, and regional expansion. The industry is moderately fragmentated, with numerous smaller & emerging and independent players alongside a few larger players offeringa variety of specialized coverage and customized solutions. The degree of innovation is low, and the impact of regulations on the industry is high. The regional expansion of industry is high, and level of partnerships & collaborations activities is moderate.

Key Insights

Cigna Healthcare, Allianz Care, Daman, and Sukoon Insurance PJSC among others hold significant market share in the UAE. These companies have established a robust market presence across Abu Dhabi, Dubai, Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al-Quwain through their well-established distribution network. Moreover, these players offer maximum coverage for complementary and alternative therapies in the MEA, North America, Europe, Asia Pacific and Latine America, which further solidify their dominance in the market.

|

Sr. No.

|

Company

|

Health Plans

|

Sum Limit/year

|

Coverage

|

Exclusions

|

Market Presence in across UAE

|

|

1

|

Cigna Healthcare

|

Healthguard Regional

|

100% covered (Up to 15 visits)

|

Physiotherapy

|

Naturopathy

|

Sharjah

|

|

2

|

MetLife UAE (Gulf)

|

Health+ Advantage

|

USD 544.46 (AED 2,000) with 10% co-pay

|

Acupressure

|

Osteopathy

|

Abu-dhabi

|

The degree of innovation in the market is low due to traditional industry practices and a lack of substantial evidence regarding these treatments’ effectiveness. This restraint, coupled with a predominant reliance on conventional medicine and slow regulatory updates, limits the progress of more innovative coverage offerings in this area.

The impact of regulations on the market is expected to remain high. The expansion of CAM by establishing facilities and providing funding to support these services. Increased integration of CAM with conventional medicine for serious conditions, coupled with the Dubai Health Authority’s 2021 regulation mandating coverage of alternative treatments in basic health insurance, is impacting the growth of the market.

The partnerships & collaborations activity in the market is moderate, driven by consolidation trends, regulatory pressures, and the demand for alternative therapies. Larger entities are actively entering into partnerships and collaborations to expand coverage offerings and navigate regulatory complexities more effectively, indicating a robust partnerships & collaboration environment in this sector. For instance, in October 2022, Allianz Care and Orient Insurance Company, partnered with NEXtCARE, Allianz Care’s sister company, launched the LiveDoc Video Consultation service in Dubai. This service allows customers to have virtual consultations with licensed doctors based in the UAE from the comfort of their homes or offices.

Regional expansion in the market is high. This is due to enhanced government support and regulatory measures. Recent policies now extend coverage to these therapies, indicating a shift towards holistic and preventive healthcare. This growth is further driven by increased consumer interest in alternative treatments and their integration into mainstream healthcare and insurance plans, which improves access and affordability, reflecting a dynamic and growing market landscape.

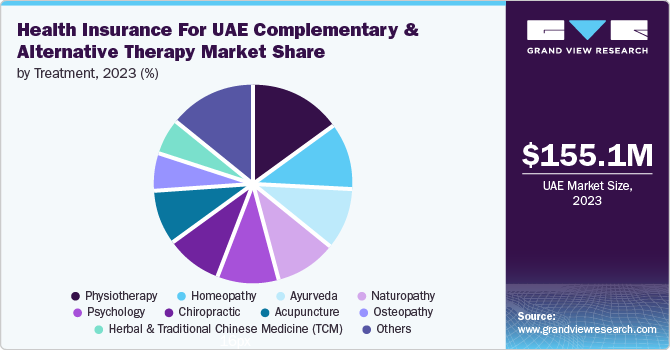

Treatment Insights

The physiotherapy segment held the largest market share of 14.90%. This can be attributed to the enhanced health coverage for physiotherapy, largely due to government efforts aimed at improving healthcare accessibility and reducing out-of-pocket expenses. Key factors include mandatory health insurance regulations in Abu Dhabi and Dubai that integrate physiotherapy into insurance packages, particularly for chronic conditions and post-surgery rehabilitation. Additionally, providers are offering broader coverage, reflecting the growing recognition of physiotherapy in preventive care and long-term health management. However, coverage limitations persist, with some providers imposing session caps or excluding preventative treatments, driving the demand in this segment.

The homeopathy segment is expected to witness fastest growth over the forecast period. The growing adoption of homeopathy is driven by its potential to reduce hospitalization duration, medication dosage, and laboratory test needs, thereby decreasing recurrence rates and overall healthcare costs for both individuals and the state. Its effectiveness in enhancing general well-being and managing chronic conditions, coupled with its lack of adverse effects and compatibility with other treatments, further boosts the demand for the segment. Increasing awareness of homeopathy’s benefits, especially for mental disorders and chronic illnesses, has led to rising patient interest and demand for coverage. This demand is supported by government initiatives, such as the Dubai Health Authority’s 2021 policy, which includes homeopathy in basic health plans with coverage up to AED 2,500 (USD 680), and a 20% copayment for outpatient visits. This regulatory support is anticipated to drive greater adoption of health plans that cover homeopathic treatments in the UAE.

Key Health Insurance For UAE Complementary And Alternative Therapy Company Insights

The market is moderately fragmented due to diverse coverage offerings and varying state-based regulations. Major companies in the UAE are acquiring emerging players and engaging in partnerships & collaborations to strengthen their position and penetrate new markets. Some of the emerging players in the market includes Salama Islamic Arab Insurance Company, ADNIC, Takaful Emarat, among others.

Key Health Insurance For UAE Complementary And Alternative Therapy Companies:

- Cigna Healthcare

- Daman

- GIG

- MetLife UAE (Gulf)

- Allianz Care

- Aetna Inc.

- Sukoon Insurance PJSC

- Nextcare

- Salama Islamic Arab Insurance Company

- MEDGULF

- United Fidelity Insurance PSC

- Al Buhaira National Insurance Company (ABNIC)

- Adamjee Insurance

- ADNIC

- Takaful Emarat

- Watania

- RAKINSURANCE

- Oriental Insurance

- Arabia Insurance Company

- National General Insurance

Recent Developments

-

In May 2024, Salama Islamic Arab Insurance Company expanded its regional presence by opening a new office in Abu Dhabi. This move marks a significant milestone in SALAMA’s strategic growth, enhancing its ability to serve the dynamic needs of the Abu Dhabi community while continuing to create long-term value for its partners and customers in the region.

-

In February 2023, Sukoon Insurance PJSC partnered with Aster DM Healthcare, launched two new health insurance plans, “Shield Saver” and “Shield Saver Plus,” targeting large- to mid-sized corporates & individuals. These plans emphasize customer convenience and accessibility, leveraging Aster DM Healthcare’s extensive network in the GCC and India. The initiative underscores Sukoon’s commitment to providing comprehensive healthcare coverage tailored to diverse needs.

-

In December 2022, Salama Islamic Arab Insurance Company acquired the insurance portfolio of Dubai Islamic Insurance and Reinsurance Company (AMAN), covering motor, medical, nonmotor, and group life insurance segments. This acquisition strengthened SALAMA’s market presence and diversified its offerings within the UAE insurance sector.

Health Insurance For UAE Complementary And Alternative Therapy Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 181.43 million

|

|

Revenue forecast in 2030

|

USD 469.51 million

|

|

Growth Rate

|

CAGR of 17.17% from 2024 to 2030

|

|

Actual data

|

2018 – 2023

|

|

Forecast period

|

2024 – 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Treatment

|

|

Country scope

|

UAE

|

|

Key companies profiled

|

Cigna Healthcare; Daman; GIG; MetLife UAE (Gulf); Allianz Care; Aetna Inc.; Sukoon Insurance PJSC; Nextcare; Salama Islamic Arab Insurance Company; MEDGULF; United Fidelity Insurance PSC; Al Buhaira National Insurance Company (ABNIC); Adamjee Insurance; ADNIC; Takaful Emarat; Watania; RAKINSURANCE; Oriental Insurance; Arabia Insurance Company; National General Insurance

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Health Insurance For UAE Complementary And Alternative Therapy Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the health insurance for UAE complementary and alternative therapy market report based on treatment.

Frequently Asked Questions About This Report

b. The health insurance for UAE complementary and alternative therapy market is expected to grow at a compound annual growth rate of 17.17% from 2024 to 2030 to reach USD 469.51 million by 2030.

b. The physiotherapy segment dominated the market with a share of 14.90% in 2023. This is attributable to the growing population, increasing prevalence of lifestyle-related musculoskeletal disorders, and enhanced health coverage due to government initiatives improving accessibility and reducing out-of-pocket costs.

b. Some key players operating in the health insurance for UAE complementary and alternative therapy market include Cigna Healthcare, Daman, GIG, MetLife UAE (Gulf), Allianz Care, Aetna Inc., Sukoon Insurance PJSC, Nextcare, Salama Islamic Arab Insurance Company, MEDGULF, United Fidelity Insurance PSC, Al Buhaira National Insurance Company (ABNIC), Adamjee Insurance, ADNIC, Takaful Emarat, Watania, RAKINSURANCE, Oriental Insurance, Arabia Insurance Company, and National General Insurance.

b. Key factors that are driving the health insurance for UAE complementary and alternative therapy market growth include the rising government initiatives and regulations for health insurance for complementary and alternative therapy, the increasing demand for alternative therapies, and the wide availability of coverage plans/offerings by insurance providers.

b. The health insurance for UAE complementary and alternative therapy market size was estimated at USD 155.08 million in 2023 and is expected to reach USD 181.43 million in 2024.

link